| Compound Annual Growth Rate (CAGR) – What You Need to Know | 您所在的位置:网站首页 › cagr irr › Compound Annual Growth Rate (CAGR) – What You Need to Know |

Compound Annual Growth Rate (CAGR) – What You Need to Know

|

In this article we will talk about CAGR (Compound Annual Growth Rate) in detail, including the formula for computing it, how to calculate it in Excel, how to interpret it, its utility in assessing financial assets, making predictions, and more: What does CAGR stand for?What is Compound Annual Growth Rate?CAGR calculation formulaCAGR calculation in ExcelHow to use a CAGR calculatorComparing investments using CAGRFinancial forecasting using CAGRDoes CAGR account for risk?Limitations of CAGRCAGR versus IRRNon-traditional usesFirst, let’s get the obvious out of the way. What does CAGR stand for?As hinted by the title, the acronym CAGR means ‘Compound Annual Growth Rate’. Such a growth rate can be computed to anything, but the term and hence the acronym is mostly used in relation to returns from financial assets and investment strategies of various kinds. What is Compound Annual Growth Rate?CAGR is the average compound annual growth rate of an asset, investment, business results such as sales, revenue, clients, users, units produced or delivered, etc.. I can be thought of as the mean rate of return over a period of time, say three years, with which the value of an investment grows from a beginning value to an ending value. The meaning of Compound Annual Growth Rate will become more clear if we break down the term into its components, starting from the last one and making our way up: ‘Rate‘ indicates that we are dealing with a ratio – the relationship between one thing and another.‘Growth‘ means we are interested in the relationship between a prior time period and a following time period, thus the rate referred to in CAGR is the ratio between a value from one time period to the next.‘Annual‘ refers to the length of each period – a year.‘Compound‘ has the same meaning as in ‘compound interest rate‘. It refers to the fact that we need to account for multiple parts, in this case the multiple year-over-year ratios.Put simply, CAGR is the average rate at which an asset grows over a given number of years. A growth rate can be calculated for a time period different than a year, in which case it is no longer called CAGR. For example, you can compute the average growth rate on a quarterly, monthly, weekly, or even daily basis. Most of the time a compound growth rate of any kind is useful in comparing growth rates across separate data sets belonging to a common domain. For example, one can compare the compound annual revenue growth rate of companies in a particular industry versus another, or to a different industry entirely, over a number of years. Internally, a corporate accountant or financial adviser might compare the growth rate of company divisions with the same enterprise. CAGR formulaThe following mathematical equation can be used to calculate the Compound Annual Growth Rate of any asset:  CAGR formula CAGR formula

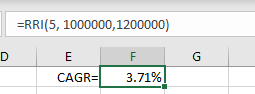

In the formula above V(t0) is the initial value of the asset, V(tn) is the final value, tn is the end time period, and t0 is the first time period. Naturally, the difference tn – t0 is the number of time periods over which the growth has been realized which in CAGR is in years, but the same formula can be used with months, quarters, etc. to calculate the respective growth rate. As you might have noticed, this is nothing other than the geometric mean of the growth rate of all year over year comparisons in the specified number of years. Example calculation:For example, let us calculate the CAGR of a real estate investment over a period of 5 years, knowing that the purchase value of the home or business property was $1 million USD and the estimated value of the investment after 5 years is $1.2 million USD. CAGR(0,5) = (1.2 / 1) ^ (1/5) – 1 = 1.2 ^ 1/5 – 1 = 1.037137 – 1 = 0.0371 Usually CAGR is presented not as a raw rate but as a percentage. To convert the above to a percentage we need to simply multiply it by 100 and add the percent sign, like so: CAGR(%) = 0.037 * 100% = 3.71% So, we have just computed using this simple equation that the Compound Annual Growth Rate of our investment was 3.7% over this 5-year period. Calculating CAGR with a partial year:All is fine if you only invest over whole years, but in reality investments often end up being liquidated without regard for periodicity. What if you held an investment in vacation rentals, a shipping company, or perhaps an entertainment corporation for over 10 years, and then liquidated it 100 days into the 11-th year? How do you calculate CAGR in this case? Fear not. There is a way, and it isn’t that difficult. You simply need to compute what part of the year those 100 days represent. To do that, simply divide 100 by 365 = 0.274. Now add 0.274 to 10 and you have the difference tn – t0 . The rest of the CAGR formula remains the same. The same logic applies if you need to calculate a compound quarterly or monthly growth rate, but instead of 365 you need to divide by 30.5 and 7, respectively. How to calculate CAGR in Excel?In newer versions of Excel (some 2013 versions, all versions newer than 2019), including Office 365 there is a neat function to compute CAGR called RRI. It takes only three parameters as input: RRI(Nper, Pv, Fv) and returns returns an equivalent average interest rate for the growth of an investment for the number of time periods (Nper) and the given present value (Pv) and future value of an asset (Fv). This is exactly the compound annual growth rate. Using the above example, we can substitute the values: Nper with 5, Pv with 1 million and Fv with 1.2 million, and we get the exact same output from Excel’s RRI function:  CAGR in Excel CAGR in Excel

If you have an older version of MS Excel, then a bit of coding would be required to implement the formula as stated above. How to use a CAGR calculatorUsing an online CAGR calculator is a great substitute for when you’re on the road or just want a convenient tool handy. You don’t need to remember the CAGR equation in Excel which is awkwardly named which makes it difficult to recall. Other than that, using a calculator works in a straightforward manner as it only has three inputs, just like the formula. All you need to know is the value of the investment / asset at the beginning of the period, the end of the period, and the number of periods to compound over. In this case that would be the number of years. What is useful in using GIGAcalculator’s online tool is that automatically outputs the total growth as well. This is helpful in applications in which you must also present the total absolute return or calculate the total rate of return, e.g. in assessing the performance of a stock market or bond market portfolio, a personal savings plan. Comparing investments using CAGROne of the most common uses for CAGR is for comparing proposed investments or investing strategies, be it in single assets or in portfolios. The growth rate of different mutual funds or hedge funds can be compared as a filter for choosing an investment vehicle. Since it only requires a few variables to be known, it is useful as a first-pass check on the viability of an offer. Further more detailed information can be used to compute more advanced metrics. Note that while CAGR may sound like an accounting term, it is not and thus it is not checked and audited the same way as accounting data. For example, one may want to compare a saving account to a more active investment strategy such as investments in high-tech companies (e.g. telecommunications, AI, biochemistry, genomics, material design), or developing markets, or any other niche. A higher CAGR number for the active strategy would indicate a higher average rate of growth for the initial investment. A lower value indicates the inverse. Obviously, CAGR should never be the sole factor for judging an investment as good or bad. Many factors contribute to what can be a good investment, and likewise for what may be a horrible one. Having some sort of insurance is recommended regardless of how good the endeavor looks on paper.  Financial forecasting using CAGR

Financial forecasting using CAGR

A compound annual growth rate can be used for forecasting of average expected financial returns if you replace the ending value of the asset in the formula with a future value from some kind of a prediction. Obviously, simple extrapolation from historical growth rates will rarely be a useful prediction. Different forces dampening or stimulating the growth rate should be taken into account by an analyst. Other than that, forecasting using CAGR is fairly straightforward insofar as the formula remains the same. All the usual limitations and caveats of the metric remain in force (some are mentioned below). Using a compound growth rate in forecasting is useful when you need to know if you can reach a given investment goal such as getting enough money in a college education fund by the time your kid is of college-age. A $10,000 investment in with an expected CAGR of just 5% will not cut it if you need to have $100,000 in the bank after just 15 years. You will need something like 16% growth rate to do that, or to invest more initially. Does CAGR account for risk?Risk has many heads, but often risk is equated to volatility and/or some measure of minimum or maximum value of an investment over a given period of time. In none of the above senses of the word (used rightly or wrongly) does CAGR assess financial risk or investment risk. Since it is an average, assets with very different price movements over the period may have the same growth rate. Let us see a few examples in the table below. YearAsset #1Asset #2Asset #30$100,000$100,000$100,0001$105,000$105,000$140,0002$110,000$80,000$132,0003$120,000$90,000$105,0004$130,000$130,000$130,000CAGR6.78% 6.78% 6.78%As you can see, these are three investments with vastly different volatility which have the same average yearly growth rate over these four years. Despite having different annual variability (usually measured in terms of standard deviation, stdev), from the point of CAGR all three assets look exactly the same. It may be said that the compound annual growth rate is an idealization of the process which governs how each of the three assets transition from the initial value to their final value. As such, it suffers from loss of information. In a sense, what makes Compound Annual Growth Rate great for certain purposes such as easy comparison of assets based on average growth is what strips it of useful qualities for other goals such as risk assessment. If you think about it in terms of technical analysis, it is akin to a smoothed average – allows you to see the big picture or trend, but hides bumps along the road. Limitations of CAGRAn important limitation for practical use in investing is that by default it does not account for adding or withdrawing funds from an investment or investment portfolio during the time period of interest. Using the beginning and end balances in cases of either fund injections or withdrawals will completely invalidate a CAGR calculation and the computed annual growth rate will be inaccurate. This is not exactly a limitation of the metric, but rather of its presentations by different mutual funds, fund managers, and so on. Sometimes a fund may have had a great run over the past three or five years, and so you would be presented with CAGR for just that period of time. However, as it is but an average the metric is highly influenced by extreme values and the shorter the period, the more likely it is that even a single bad year will throw the entire indicator off. The established advice is to calculate growth rate for as long as there is data, unless a major event makes data prior to it incomparable or unsuitable for use. Should you use IRR instead of CAGR?IRR or Internal Rate of Return is another way to measure the return on an asset the value of which is subject to changes. It is often called discounted cash flow rate of return. Similarly to CAGR, IRR does not take into account external factors like capital cost, currency inflation, etc. unless specifically accounted for in the input. Since it works on all yearly returns instead of just the present value and future value of the investment (beginning value and ending value) it results in a more nuanced computation which will penalize higher volatility somewhat, especially since it gives more weight to earlier cash flow movements compared to later ones due to the time preference of investors. The utility of CAGR historically was the simplicity of its formula and calculation. It could also be computed with minimal information. However, since nowadays both computations and information are generally not an issue and there are free IRR calculators like ours, it is advisable to use IRR instead of CAGR whenever the full information is available. Notably, CAGR only assumes a single outflow (investment) and a single inflow (cash out), so it is unsuitable for more complex scenarios. Full comparison of CAGR, IRR, and XIRR Non-traditional Uses of Compound Annual Growth RatesWhile it is widely recognized as a financial annual growth rate computation, CAGR could be employed in other types of applications. For example, a municipality or township might use it to compute its annual growth rate in terms of number of citizens, number of houses, in terms of GDP, or another key metric. An actor or singer can measure the growth of their following in a similar fashion. Politicians may use it to compare their voter base growth rate to a competing politician. Obviously, some of these will be less meaningful than in financial matters, while others may be surprisingly useful, e.g. a census is usually conducted every 10 or so years so CAGR can be used to reconstruct an idealized time series based on it. Final WordsThe Compound Annual Growth Rate is a useful tool for a quick comparison of the average growth rate of different assets and investment opportunities, either historically or in terms of a forecast. However useful its simplicity for a first assessment, it should never be the single deciding factor in a serious financial or investment advice or system. A CAGR calculation should always be complemented with other measures and assessments.  Georgi Georgiev Georgi GeorgievAn applied statistician, data analyst, and optimizer by calling, Georgi has expertise in web analytics, statistics, design of experiments, and business risk management. He covers a variety of topics where mathematical models and statistics are useful. Georgi is also the author of “Statistical Methods in Online A/B Testing”. |

【本文地址】